Penny stocks are low-priced, high-risk investments offering significant return potential. Traded over-the-counter, they attract speculative investors seeking rapid gains. Balancing risk and reward is essential.

Understanding the Basics of Penny Stocks

Penny stocks are low-priced shares, typically trading below $5, often on over-the-counter (OTC) markets. They represent small, emerging companies with high risk but potential for rapid growth. These stocks are affordable, allowing traders to buy large quantities, but they come with high volatility and liquidity challenges. Understanding their speculative nature is key to navigating this market effectively.

Why Investors Are Drawn to Penny Stocks

Penny stocks attract investors with their high-risk, high-reward potential. Low prices allow traders to buy large quantities, amplifying gains. The chance for significant returns, even from small investments, appeals to those seeking rapid growth. Additionally, penny stocks offer opportunities to invest in emerging companies early, potentially benefiting from their success. This makes them a tempting, albeit risky, option for speculative investors.

Strategies for Cherry Picking Penny Stocks

Effective strategies involve in-depth research, diversification, and disciplined risk management. These approaches help balance the high-risk nature of penny stocks and maximize potential returns.

Conducting Due Diligence on Potential Investments

Thorough research is crucial when selecting penny stocks. Analyze financial statements, management backgrounds, and industry trends. Verify the company’s legitimacy and market position. Stay informed about news and sector developments to make educated decisions, reducing risks in this volatile market.

Using Technical Analysis to Identify Promising Stocks

Technical analysis helps identify penny stock opportunities by studying price patterns and trends. Use indicators like moving averages, RSI, and volume to spot potential breakouts. Volatile penny stocks often form recognizable patterns, such as island reversals, which can signal trend reversals. Combining technical insights with market sentiment enhances decision-making in this high-risk, high-reward environment.

Leveraging News and Market Sentiment for Opportunities

News and market sentiment can significantly impact penny stocks. Positive company announcements or sector trends often drive rapid price movements. Monitoring news and sentiment allows traders to capitalize on emerging opportunities. Tools like news scanners and sentiment indicators help identify stocks poised for growth, enabling timely and informed trading decisions in volatile markets.

Risks and Challenges in Penny Stock Investing

Penny stocks are high-risk investments due to their volatility, low liquidity, and susceptibility to manipulation. Many lack regulatory oversight, increasing the potential for fraud and significant losses.

High Volatility and Liquidity Issues

Penny stocks are notorious for their extreme price swings, driven by news sensitivity and market sentiment; Low liquidity exacerbates volatility, making it difficult to enter or exit positions without impacting prices. This instability creates both opportunities and risks, requiring traders to act swiftly and strategically to navigate these unpredictable markets effectively.

Manipulation and Fraud Risks

Penny stocks are vulnerable to manipulation and fraud due to their low oversight. Scammers often exploit these markets through false information and pump-and-dump schemes. Investors must remain vigilant, verifying company details and avoiding unsolicited investment advice. These risks highlight the importance of thorough due diligence to protect against financial losses in this high-risk environment.

Managing Emotional and Financial Risks

Penny stock investing demands emotional resilience due to extreme volatility. Investors often face stress from rapid price swings, leading to impulsive decisions. Financial risks include significant losses due to poor liquidity and manipulation. To mitigate these, set strict risk tolerance levels, use stop-loss orders, and avoid overleveraging. A disciplined approach and patience are crucial to navigating this high-stakes environment effectively.

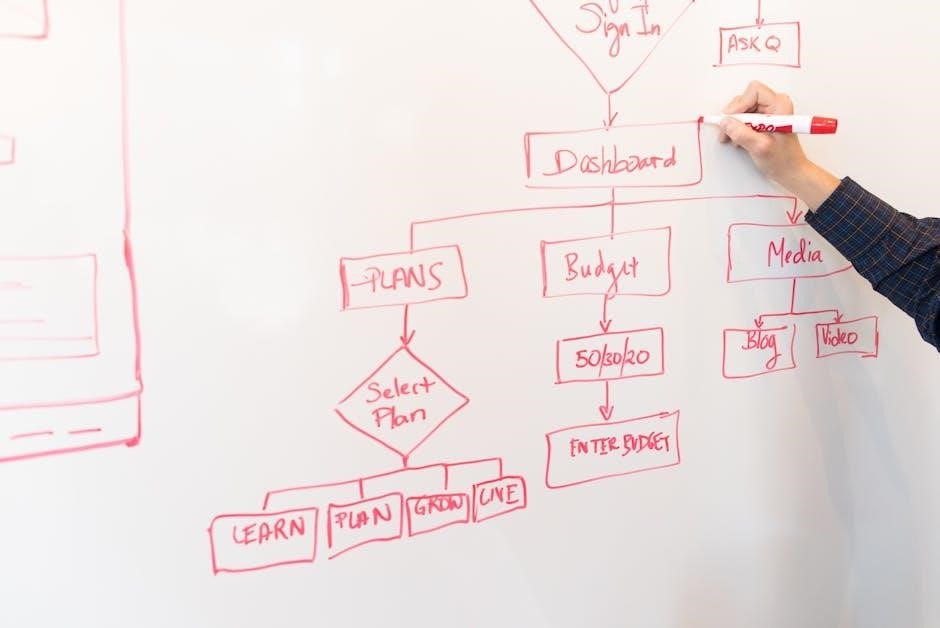

Tools and Resources for Successful Penny Stock Trading

Essential tools include stock screeners, technical indicators, and expert guides. These resources help traders identify opportunities, analyze patterns, and make informed decisions in volatile markets.

Best Stock Screeners for Penny Stocks

Stock screeners like Finviz, TradingView, and Yahoo Finance are essential tools for identifying penny stocks. These platforms allow users to filter by price, volume, and market cap, helping traders spot potential opportunities. Advanced features such as real-time data and customizable alerts enable investors to stay informed and make timely decisions in fast-moving markets.

Essential Technical Indicators for Penny Stock Traders

Key technical indicators for penny stock traders include moving averages, RSI, MACD, and Bollinger Bands. These tools help identify trends, volatility, and potential buy/sell signals. Moving averages smooth price data, while RSI highlights overbought/oversold conditions. MACD signals trend strength, and Bollinger Bands reveal volatility spikes. Combining these indicators with price action patterns can enhance trading decisions in volatile penny stock markets.

Utilizing Expert Guides and Educational Resources

Leveraging expert guides and educational resources is crucial for success in penny stock trading. Experienced traders and financial educators offer insights through books, webinars, and online courses. Resources like Peter Leeds’ guide provide practical strategies, while platforms such as StockstoTrade offer tutorials and tools. These materials help traders refine their skills, understand market dynamics, and develop disciplined investment strategies. Continuous learning enhances decision-making and reduces risks.

Lessons from Seasoned Penny Stock Investors

Seasoned investors emphasize disciplined strategies, thorough research, and avoiding emotional decisions. Continuous learning and adapting to market trends are key to long-term success in penny stocks.

Key Insights from Successful Traders

Successful traders emphasize thorough research, diversification, and understanding market trends. They stress the importance of liquidity and emotional control. While high returns are possible, they caution against reckless strategies, advocating for disciplined approaches. Continuous learning and adaptability are crucial. These insights help balance the high-risk nature of penny stocks with strategic opportunities for growth.

Avoiding Common Mistakes in Penny Stock Investing

Investors should avoid emotional decisions and overtrading. Diversification is key to minimize risk. Falling for pump-and-dump schemes and ignoring due diligence are costly errors. Set clear exit strategies and never invest more than you can afford to lose. These pitfalls can be mitigated with education and disciplined strategies to enhance long-term success in penny stock markets effectively.

Diversification and Portfolio Management

Diversification is key to managing risk in penny stock investing. Allocate only a small portion of your portfolio to penny stocks to balance risk and reward effectively.

Building a Balanced Portfolio with Penny Stocks

Building a balanced portfolio with penny stocks involves careful planning and diversification. Start by allocating a small percentage of your portfolio to penny stocks to manage risk. Diversify across various sectors to avoid concentration in a single area. Research company fundamentals, industry trends, and market liquidity to make informed decisions. Set clear investment goals and implement risk management strategies, such as stop-loss orders, to protect your capital. Regularly monitor your investments and stay informed about market developments to adapt your strategy as needed. By balancing high-risk penny stocks with more stable investments, you can create a diversified portfolio that aligns with your financial objectives.

Setting Clear Investment Goals and Risk Tolerance

Setting clear investment goals and risk tolerance is essential for successful penny stock investing. Define whether you seek short-term gains or long-term growth. Assess your risk tolerance, as penny stocks are highly volatile. Align your strategy with your financial capacity and knowledge level. Establishing these boundaries helps avoid impulsive decisions and ensures a disciplined approach to managing investments effectively.

Mental and Strategic Preparation

Mental preparation involves building knowledge, discipline, and emotional resilience. Develop a strategic plan, set realistic goals, and stay patient. Avoid impulsive decisions and focus on long-term success.

Developing a Winning Mindset for Penny Stock Trading

Building a winning mindset involves embracing discipline, patience, and emotional resilience. Successful traders stay focused on long-term goals, avoiding impulsive decisions. Cultivate a deep understanding of market dynamics, and remain adaptable to changing conditions. Avoid greed and fear, sticking to a well-defined strategy. Continuous learning and self-reflection are key to refining your approach and achieving consistent success in this high-risk environment.

Creating a Strategic Investment Plan

A well-structured plan is crucial for success in penny stock trading. Define clear financial goals, assess risk tolerance, and diversify investments across sectors. Allocate a small portion of your portfolio to penny stocks, ensuring they align with your overall strategy. Use stock screeners to identify potential stocks, and integrate technical analysis for informed decisions. Regularly review and adjust your plan to adapt to market changes and stay disciplined in execution.

Case Studies and Real-World Examples

Plug Power (PLUG) surged from $3 to $63, illustrating penny stocks’ potential. Failed investments highlight risks, offering valuable lessons for refining strategies and improving decision-making skills.

Success Stories in Penny Stock Investing

Penny stocks have created life-changing fortunes for some investors. Plug Power (PLUG), for instance, surged from $3 to $63 in a year, delivering over 2,000% returns. Similar success stories exist, though rare, highlighting the potential for outsized gains. These examples inspire traders but also underscore the importance of research, strategy, and risk management to replicate such successes. Success is rare but achievable with dedication and insight.

Learning from Failed Investments

Failed penny stock investments often stem from chasing unrealistic gains, lack of research, or emotional trading. These setbacks teach valuable lessons about diversification, risk management, and the importance of strict exit strategies. Learning from mistakes helps refine investment approaches and builds resilience; Understanding common pitfalls, such as fraud risks and liquidity issues, is crucial for improving future outcomes and avoiding costly errors.

A Step-by-Step Guide to Getting Started

Start by selecting a reputable brokerage with penny stock expertise. Understand fees, open an account, and begin with small, research-backed investments to build confidence and knowledge.

Choosing the Right Brokerage for Penny Stocks

Selecting a reliable brokerage is crucial for penny stock trading. Look for brokers offering access to OTC markets, low commission fees, and robust trading tools. Ensure they provide real-time data, stock screeners, and reliable customer support. A good brokerage simplifies trading and enhances your chances of success in the volatile penny stock market.

Executing Your First Penny Stock Trade

Executing your first penny stock trade requires careful preparation. Start by selecting a stock through thorough research or screeners. Place a limit order to control costs. Monitor trade execution and consider starting with a small position to manage risk. Keep emotions in check and stick to your strategy for a disciplined approach to trading penny stocks effectively.

Monitoring and Adjusting Your Strategy

Regularly monitor your penny stock trades, tracking price movements and market changes. Adjust your strategy based on new information or shifting trends. Use technical indicators to identify exit points and optimize returns. Stay informed about company news and sector developments to refine your approach. Rebalance your portfolio as needed to manage risk and maintain alignment with your investment goals.

Penny stocks offer high-risk, high-reward opportunities for investors. While potential gains are enticing, caution and a well-informed strategy are crucial. Stay disciplined, keep learning, and prosper.

Summarizing the Key Takeaways

Penny stocks offer a high-risk, high-reward investment opportunity. Success requires education, strategy, and discipline. These stocks are speculative and demand constant vigilance. Always research thoroughly and manage risks. Penny stocks can deliver substantial returns for the informed and cautious. Stay proactive, learn from experiences, and stay informed to navigate this volatile market effectively.

Encouragement and Next Steps for Aspiring Investors

Embark on your penny stock journey with confidence and caution. Start by educating yourself using reliable resources. Open a brokerage account and practice with small, manageable trades. Set clear goals and stick to your strategy. Stay disciplined, learn from every trade, and grow your portfolio steadily. The rewards can be significant for those who approach this market with dedication and resilience.